Join every day information updates from CleanTechnica on e-mail. Or observe us on Google Information!

Plugin automobiles are all the fashion within the Chinese language auto market, with plugins scoring 743,000 gross sales (in a 1.7-million-unit general market). That’s up 29% 12 months over 12 months (YoY).

Wanting deeper on the numbers, BEVs had been up 16%, whereas PHEVs did even higher, leaping 62% in March. Breaking down plugin gross sales by powertrain, BEVs had 64% of gross sales, beneath this 12 months’s common of 67%, proving the rising recognition of plugin hybrids on this market.

The year-to-date (YTD) tally is near 1.9 million models, with Q1 ending with 36% progress YoY.

Share-wise, March noticed plugin automobiles hit 43% market share! Full electrics (BEVs) alone accounted for 28% of the nation’s auto gross sales. This pulled the 2024 share additionally to 39% (26% BEV), and with rumours that April would be the first month ever to succeed in the 50% mark, the primary half of the 12 months ought to finish above 40%. (And perhaps above 50% by 12 months finish?)

Total High 10 — BYD’s Struggle on ICE Begins

The rostrum was 100% plugins. Two BYDs had been on prime, adopted by the Tesla Mannequin Y. The most effective promoting ICE mannequin was the Nissan Sylphy, with near 30,000 models bought. The Japanese mannequin was the primary of 4 ICE fashions within the prime 10. Amongst them, the shock was the Mercedes C-Class ending in eighth, with slightly greater than 20,000 gross sales.

Benefitting from its current Struggle on ICE, within the Chinese language market, BYD positioned 5 fashions within the general prime 10! Value cuts from the Shenzhen make are pressuring not solely the ICE competitors, but in addition the plugin adversaries….

Talking of ICE competitors, the place the international OEMs (nonetheless) have their bread and butter volumes, it’s fascinating to see that, a 12 months in the past, 52% of the general market belonged to the native OEMs, whereas now they’ve 59% of the similar pie. Contemplating that international OEMs at the moment personal simply 15% of the plugin market in China, versus 41% general, and that this market is quickly being electrified, it’s clear to see that … there will likely be blood.

Chip in a number of {dollars} a month to assist help impartial cleantech protection that helps to speed up the cleantech revolution!

Chip in a number of {dollars} a month to assist help impartial cleantech protection that helps to speed up the cleantech revolution!

Total Market by Segments — BYD Wins Four Out of 5 Classes

Wanting on the a number of classes, the A (metropolis automobiles) and D (midsize) segments proceed to have 100% PEV podiums, whereas the C (compact) section is the one one the place ICE automobiles are nonetheless a majority. Possibly it’s time for BYD to launch a aggressive compact hatchback? One thing just like the MG4/Mulan?

Anyhow, except for the C section, the place the Nissan Sylphy nonetheless troopers on as the only real ICE class chief, BYD is forward in each different class. The shock comes from the second youth of the BYD Han, which, regardless of fierce competitors, has tremendously benefitted from BYD’s value cuts to return to the highest of the complete dimension class. In doing so, it beat heavyweights (in each senses of the phrase…) just like the AITO M7 and the Li Xiang L7.

Finest Promoting EVs — One by One

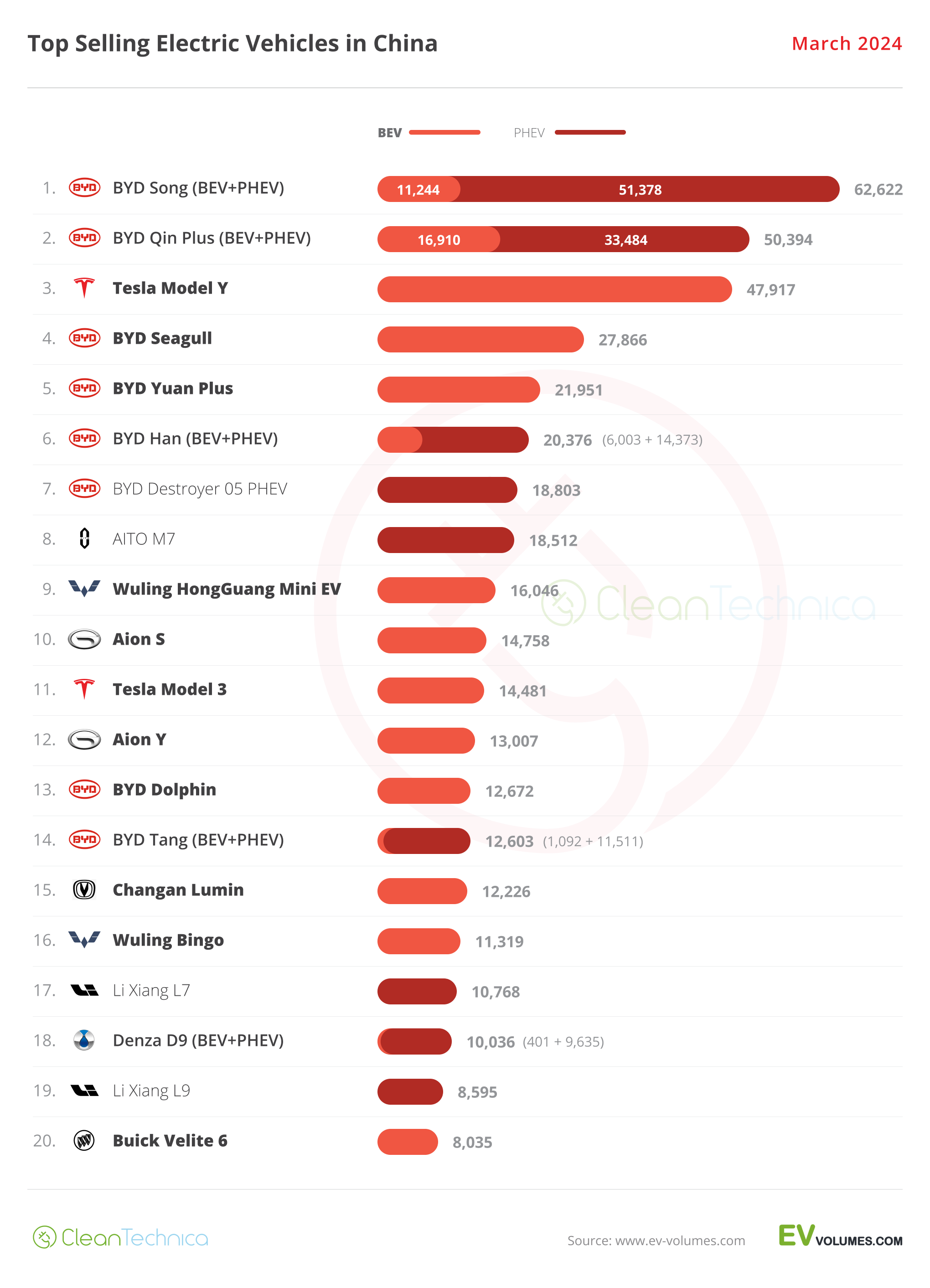

Relating to final month’s greatest sellers desk, the highest Three greatest promoting fashions within the general desk precisely mirrored those within the EV desk — which as soon as once more proves the merging course of that we’re witnessing between the 2 tables. Right here’s extra information and commentary on March’s prime promoting electrical fashions:

#1 — BYD Tune (BEV+PHEV)

BYD’s midsize SUV is the uncontested chief within the Chinese language automotive market, and this time, the star participant returned to the management place, surpassing its Qin Plus sibling. The midsize SUV scored 62,622 registrations, with 11,244 models belonging to the BEV model. Will the Tune proceed to rule within the Chinese language automotive market? Properly, it will depend on the competitors, particularly the inner competitors. Presently, the Tune solely has the lately launched Tune L as inside competitors, however the upcoming Sea Lion 07 and the premium car-on-stilts Denza N7 (a automotive that sits someplace between the Tesla Mannequin Y and the Zeekr 001) are each additionally wanting a chunk of the pie. That is most likely an excessive amount of competitors inside BYD’s midsize SUV portfolio for the Tune to proceed clocking 50,000 gross sales/month, a needed threshold to proceed main the cutthroat Chinese language auto market, however due to its current value cuts, the Tune is constant its success story.

#2 — BYD Qin Plus (BEV+PHEV)

Together with the Tune, the BYD Qin has been a bread and butter mannequin for the Chinese language automaker for a very long time. The midsize sedan reached 50,394 registrations in March (16,910 models belonged to the BEV model), a brand new report for the long-running nameplate. This allowed it to be second within the general market, with the sedan benefitting from being the primary pawn launched by BYD in its current “Struggle on ICE” marketing campaign (aka value cuts). Costs now begin at 80,000 CNY ($12,000) and demand is certain to remain excessive. Regardless of the sturdy inside competitors — a brand new, fancier Qin L is claimed to be launching quickly — anticipate BYD’s decrease priced midsize sedan to proceed posting sturdy outcomes at the price of the competitors, EV or ICE, all whereas retaining its most direct opponents — the Tesla Mannequin 3, Wuling Starlight, and GAC Aion S — at a secure distance.

#3 — Tesla Mannequin Y

Tesla’s star mannequin bought 47,917 registrations, which allowed it to land in third within the general rating. It appears the US crossover is at cruising pace within the Chinese language market, at round 25,000–30,000 models a month, peaking at about 45,000 models within the final month of the quarter. Whereas that doesn’t make it the most effective vendor out there, it permits the Mannequin Y to maintain Tesla related within the Chinese language market, and considerably disguises the frosty reception that the refreshed Mannequin Three had on this market (extra on this additional beneath).

#4 — BYD Seagull

Issues proceed to go nicely for the hatchback mannequin, with the small EV securing one other prime 5 presence due to 27,866 registrations. With a part of manufacturing now being diverted to export markets, it appears demand for the little Lambo is now at cruising pace in China. The perky EV is now in prime 5 territory. Even with its consideration now diverted to different geographies, like Latin America and Asia-Pacific, anticipate the little BYD to proceed being a part of the BYD pack that populates the Chinese language prime 10. What about export prospects to Europe? There are talks that the mannequin will likely be launched in Europe within the second half of the 12 months. After all, don’t anticipate the low costs in Europe that the Seagull has in China. When town EV lands, because the Dolphin Mini, European costs will likely be considerably larger for a variety of causes (tariffs, VAT, and so on.), however I wouldn’t be stunned if it began at 17,999€ … which might nonetheless be a killer value contemplating the direct competitors is north of 20,000€.

#5 — BYD Yuan Plus

A giant beneficiary of the current value cuts, the compact crossover returned to the highest 5, due to 21,951 gross sales, retaining its most direct rival, the Aion Y (#12 with 13,000 registrations) at a secure distance. With the upcoming launch of the BYD Yuan Up, gross sales of the Yuan Plus might endure. The brand new crossover will not be that a lot smaller (4,32 mt vs. 4,46 mt), however it’s considerably cheaper (CNY 97,000 vs. CNY 120,000) AND has a extra regular design, particularly inside, which could postpone some however could possibly be a plus aspect for others. One factor is definite: anticipate the Yuan As much as be one other gross sales success for BYD. Now, about that compact hatchback…

the remainder of the most effective vendor desk, the spotlight additionally comes from BYD, with the Han flagship sedan returning to type and ending March in sixth with 20,376 gross sales. Slightly below it, the #7 Destroyer 05 breaks its private report, registering 18,803 models, thus making it six BYDs within the prime 7 positions.

However, a few of BYD’s opponents (and Xiaomi’s?) have taken a beating. The AITO M7, an everyday presence within the final prime 5s, dropped to eighth, with 18,512 gross sales. Li Auto’s greatest performer, the L7, was simply 17th, down from eighth in February, with 10,768 gross sales (perhaps the upcoming and cheaper L6 mannequin is casting a shadow over its greater sibling). In the meantime, fashions just like the Wuling Starlight, Geely Galaxy L7, Chery Fengyun A8 PHEV (#14 in February), and Geely Panda Mini, simply to call a number of, vanished from the highest 20. As mentioned earlier than, BYD’s Struggle on ICE can be affecting the EV competitors….

Why Tesla Determined To not Refresh the Mannequin Y in 2024

… And, talking of EV competitors, the Tesla Mannequin Three is unquestionably having a nightmarish 2024 in China. Within the context of a double-digit rising market and a current refresh, it’s astonishing to seek out that the Tesla sedan is down 25% YoY within the first quarter of the 12 months!

In the identical interval, the unrefreshed Tesla Mannequin Y was up by 6%. Positive, nothing particularly nice to have fun, however at the very least it’s not seeing demand fall off a cliff….

Even limiting the view to sedans, the Tesla Mannequin Three was solely fifth in March, with 14,481 gross sales, beneath the all-electric Aion S (14,758) and the BEV model of the BYD Qin Plus (16,910). And March was presupposed to be a peak month!

This proves that the refresh wasn’t nicely obtained by the Chinese language market. True — specs and the inside had a welcome improve, however the exterior design change, which ditched the Porsche Panamera resemblance and embraced the 2019 Toyota Corolla look, together with the sensation that Tesla was stingy with gear by eradicating stalks, parking sensors, and so on., has affected the enchantment of the automotive. And in a cutthroat market like China, these form of missteps will harm you.

Therefore the rationale why Tesla determined to postpone the refresh of its Mannequin Y greatest vendor. It appears they want to have extra time to determine what went unsuitable with the Mannequin Three refresh and do it correctly at a later stage.

Extra High 20 Notes

Two remaining notes on the March prime 20: The Denza D9 returned to the desk, in #18, thus making it 9 fashions out of the highest 20 coming from BYD Group; whereas the third international mannequin within the desk this time wasn’t a Volkswagen, however … Buick’s Velite 6!

Yep, Buick has a profitable EV in China(!), which is a compact(!!) and a station wagon(!!!), and it ended March in 20th place with 8,035 gross sales. Would such a mannequin achieve success within the USA? Focus on.

Outdoors the highest 20, there are a number of fashions value wanting into, just like the Cadillac Escalade sized AITO M9 registering a report 5,446 gross sales in March. Will AITO’s new flagship yacht be as profitable in its class because the M7? Presently, the chief within the humongous SUV class is the Li Xiang L9 (18th in March with 8,595 gross sales). So, the gap isn’t that massive….

The Zeekr 001 obtained a refresh lately, and it reveals, with the flagship mannequin delivering 7,503 models in March. In the meantime, Changan’s new EV model, referred to as Qiyuan, had its A05 sedan attain 5,622 gross sales, which is an effective begin for Changan’s new division.

Final, however absolutely not least, a point out goes out to a mannequin that solely began to get delivered in April however is anticipated to succeed in 70,000 to 100,000 gross sales within the remaining months of 2024: the Xiaomi SU7. It’s a automotive with unbeatable worth for cash. It’s the dimension of a Tesla Mannequin S, has air suspension, has a 0.195 drag coefficient, has 800-volt structure, has 74 kWh LFP or 101 NMC batteries with a promise of a 150 kWh coming in a while, and all of this for Tesla Mannequin Three costs. That’s … fairly a proposal.

No surprise they’ve already locked in 70,000 orders. Not reservations, precise orders. With the electronics large making ready the SUV model of the SU7 for 2025, and a smaller, lower-cost mannequin is ready to land in 2026, Xiaomi could possibly be a disruptive power available on the market.

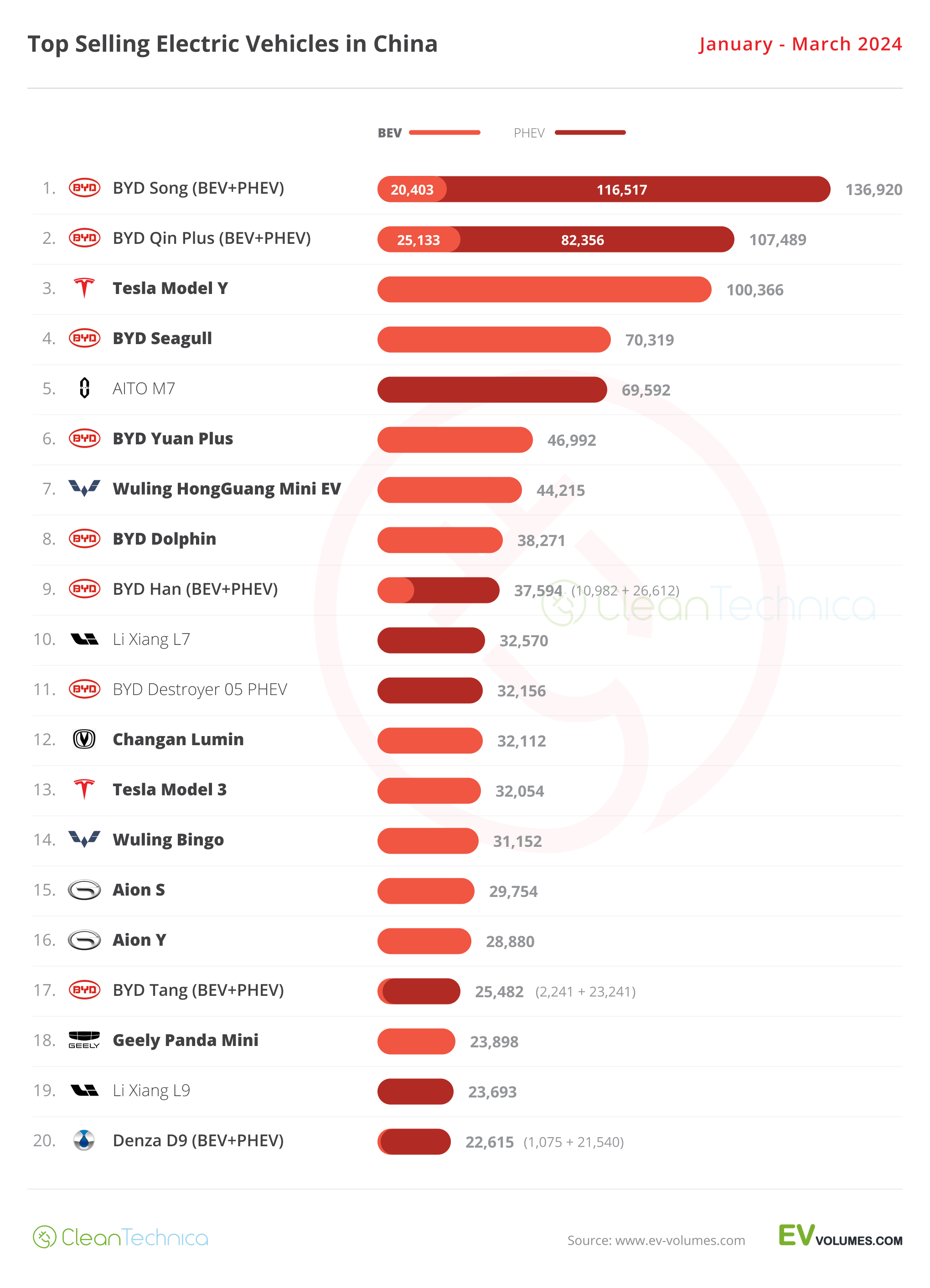

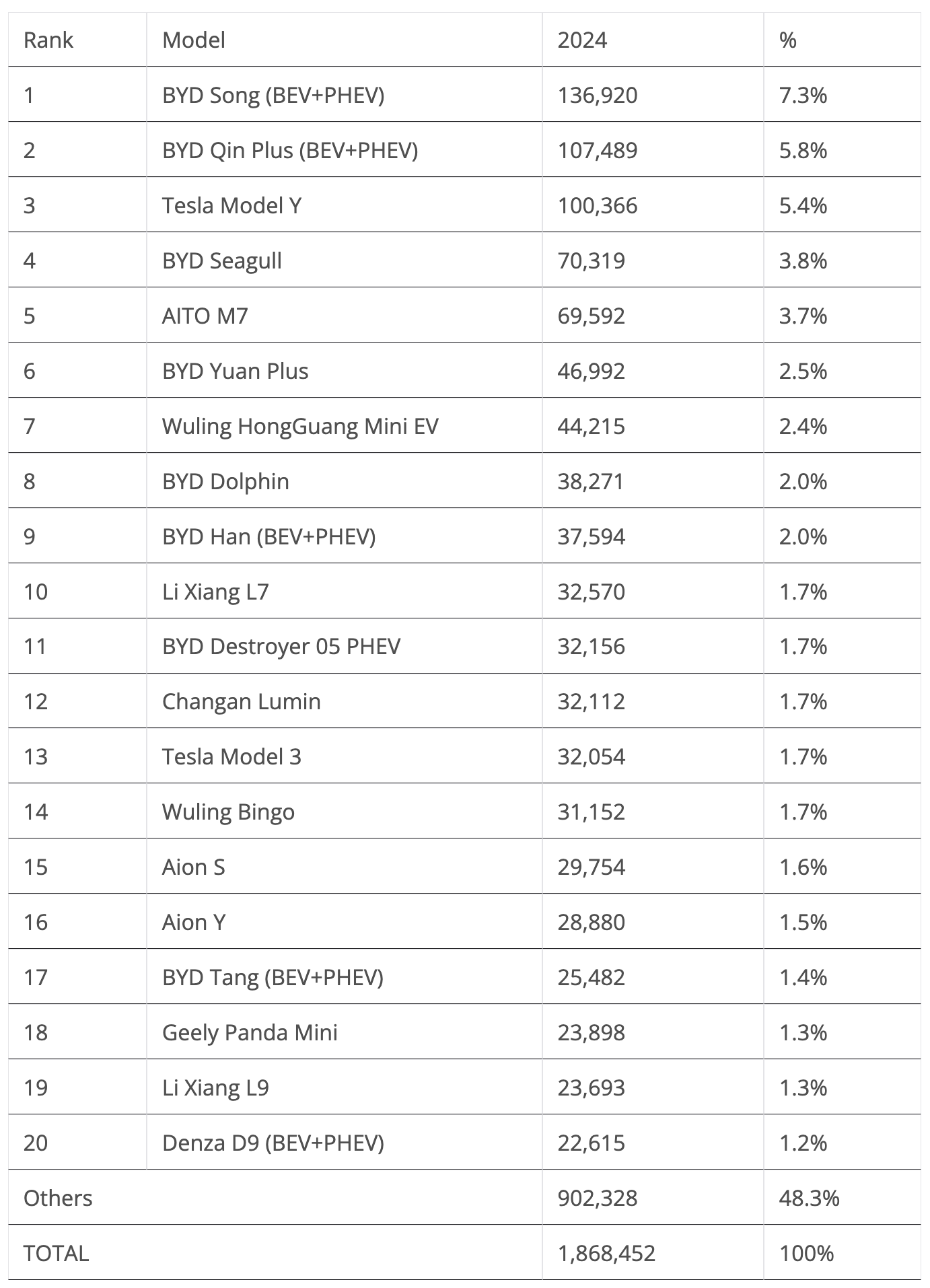

The 20 Finest Promoting Electrical Automobiles in China — January–March 2024

Wanting on the 2024 rating, there’s nothing new within the podium positions, with the the YTD rating mimicking March’s desk (BYD Tune, BYD Qin Plus, Tesla Mannequin Y).

The primary place change occurred slightly below the rostrum, with the BYD Seagull surpassing the AITO M7 — BYD’s child Lambo climbed to 4th whereas the Huawei-backed SUV dropped to fifth.

One other BYD on the rise was the Yuan Plus, which jumped two positions to sixth, surpassing the Wuling Mini EV and its BYD Dolphin sibling.

Nonetheless on the theme of BYD fashions on the rise, the Han sedan was as much as ninth, a four-position leap, whereas the Destroyer 05 did even higher, taking pictures up Eight positions in only one month, from #19 in February to its present #11 spot. The sporty model of the Qin Plus is having its greatest second ever available on the market, due to some beneficiant value cuts.

Relating to the decrease positions on the desk, the BYD takeover continued, with the Tang SUV re-joining the desk at #17 and the Denza D9 MPV again on the most effective sellers chart at #20.

Lastly, the one non-BYD mannequin that managed to climb positions was GAC’s Aion S, that was up three spots, to #15, surpassing its Aion Y (#16) sibling.

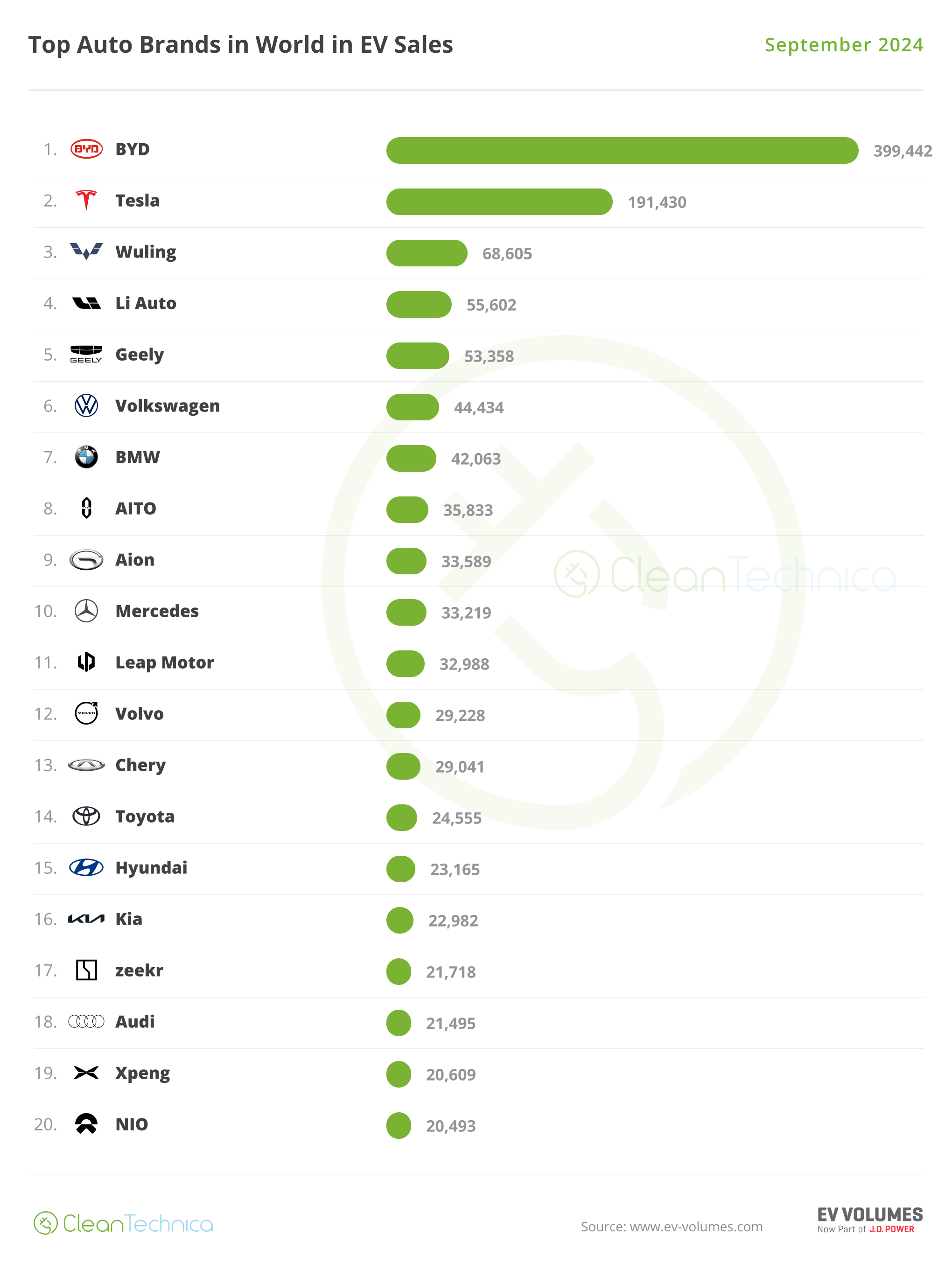

Modifications within the Total Model Rating

In March, whereas the highest three positions mirrored the 2023 full 12 months rating, with BYD on prime, adopted by Volkswagen and Toyota, the dynamics are fairly completely different. BYD (245,000 gross sales) grew 35% YoY, whereas #2 Volkswagen (159,000 gross sales) was down by 2% and Toyota (113,000 gross sales) dropped by 8%. So, whereas the primary continues to be rising quick, the opposite two are doing their greatest not lose an excessive amount of floor in a quick altering market.

Geely (80,000 gross sales) was 4th in March, signaling a 24% progress price. However, Honda, the 4th greatest promoting model in 2023, was solely eighth in March, with 60,000 gross sales, a 26% drop YoY. The Japanese model skilled the most important crash inside the prime 20. Though, #6 Tesla wasn’t a lot better, having dropped 19% YoY in the identical month. Though, a part of Tesla’s fall will be defined by the flattening of the supply curve — the reality is that the US automaker was down 4% within the first quarter of 2024.

Auto Manufacturers Promoting the Most Electrical Automobiles in China

Wanting on the auto model rating, there’s some main information, however not on the prime. BYD (29.3%, up from 28.3%) tightened its grip on its management place, and there’s actually no technique to see this domination finish anytime quickly.

Issues get extra fascinating beneath, although. Benefitting from Wuling’s gross sales bleed (5.8%, down from 6.2% — SAIC’s low price model is one in all BYD’s Struggle on ICE victims), Tesla (7.1%, up from 6.2% in February) is now snug in second place, so it could possibly be attainable for the US automaker to repeat it 2023 runner-up end.

#Three Geely additionally suffered from the current BYD value cuts, having seen its share drop from 5.2% in February to 4.7% on the finish of the primary quarter (it had no prime 20 representatives in March), however nonetheless, it recovered one spot, rising to 4th, as a result of AITO crashed (4.4%, down from 5.3%) — the startup model continues to be too depending on the M7’s efficiency. One dangerous month from the SUV mannequin and issues go south fairly quick.

Lastly, Li Auto, regardless of additionally dropping share, had its losses contained (4.3% now, vs. 4.6% in February) and will look to surpass AITO in April and return to the highest 5.

Auto Teams Promoting the Most Electrical Automobiles in China

OEMs/automotive teams/alliances, BYD Group is comfortably main, with 31.2% share of the market, a full 2% achieve in March. That enhance in share was due to the sturdy results of the namesake model, but in addition due to sturdy outcomes from its premium branches, Denza, Fang Cheng Bao, and Yangwang.

Geely–Volvo is a distant runner-up, with 8.7% share, and is being threatened by SAIC (8.5%), in third. Though, one ought to spotlight that each misplaced some half share level final month, with each OEMs being badly hit by BYD’s current value struggle.

Tesla (7.1%, up from 6.2%) surpassed Changan and is now 4th, however Changan itself can not complain an excessive amount of, as its new Qiyuan model allowed it to remain afloat (6.7%, up 0.1%) within the present value struggle blood tub.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Video

[embedded content]  Commercial

Commercial

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.